TL;DR

U.S. Stablecoin regulation is inevitable — reshaping winners and losers in both TradFi and digitally native firms.

Legacy media’s decline hasn’t deconcentrated attention — it’s just redistributed it across new platforms.

Bitcoin adoption is accelerating, from Texas to Prague, as political responses chase headlines and miss fundamentals.

Community and the Coffee House

“The truth here is not broadcast. It’s whispered. That’s why we built our own signals.”

— Overheard last week in a café off Prague Square, sometime between Powell’s presser and Trump’s Truth… and a line echoing one of my favorites: Natural Born Heroes.

Last week, the signal was loud — amplified by the informed, available to the ready, and ignored by those chasing noise.

A U.S. airstrike in Iran wasn’t announced through official channels. It was first posted by Donald Trump on Truth Social, turning a former president’s meme-fueled media venture into the world’s most unexpected geopolitical newswire.

A U.S. airstrike in Iran wasn’t announced through official channels. It first broke on Truth Social, turning a meme-fueled media platform into an unlikely geopolitical wire service.

Meanwhile, Jerome Powell held court at a press conference where “inflation” was his most-used word — but fiscal policy went unmentioned. And quietly, Congress advanced the GENIUS Act, a foundational step toward regulated Stablecoin infrastructure.

I happened to be in Prague, surrounded by Bitcoiners, economists, and builders. What stood out wasn’t just the news cycle — it was how different the time horizon felt. Less reactive. More thoughtful.

Oil, NOT bitcoin swings the most in a volatile week.

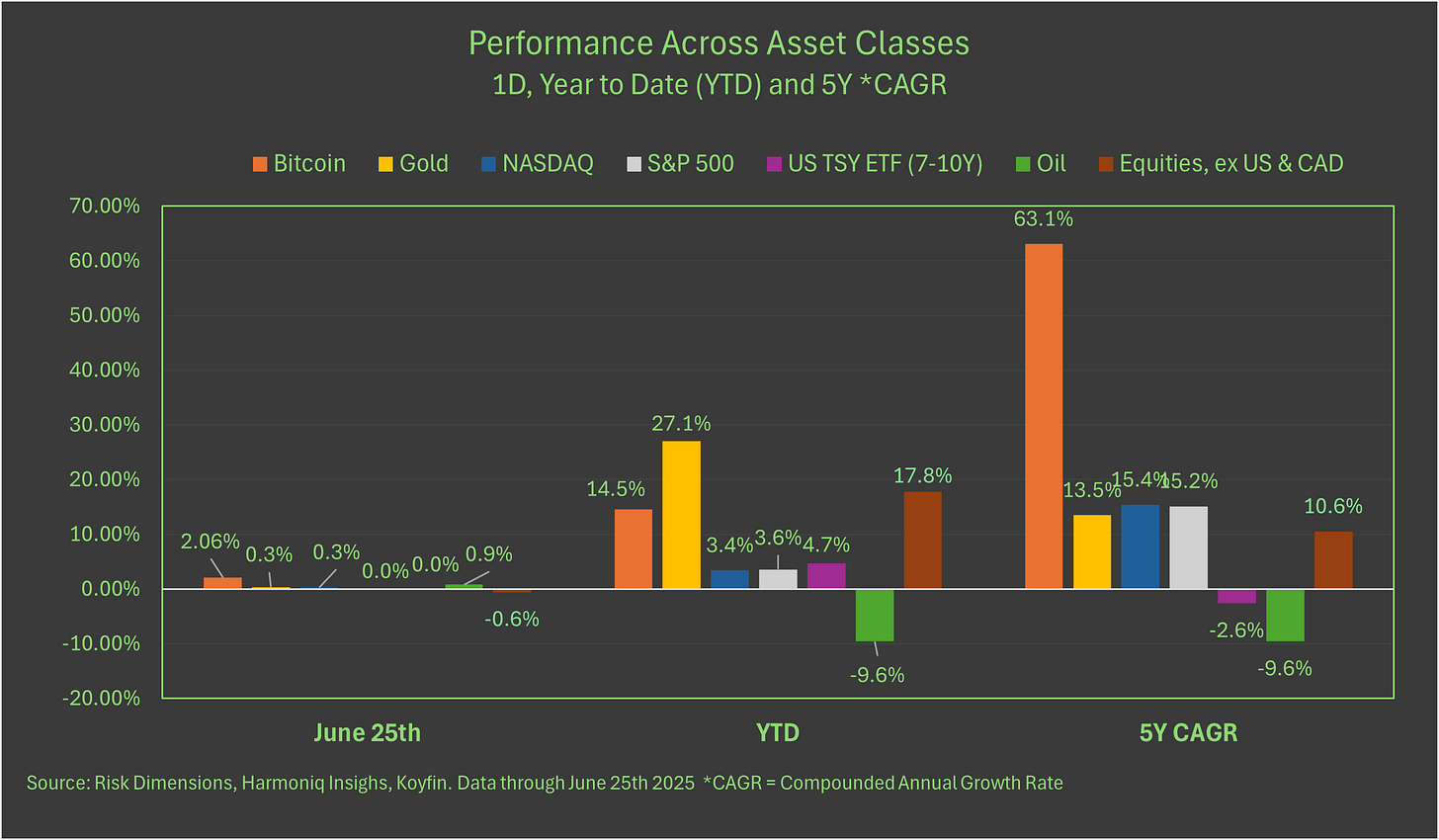

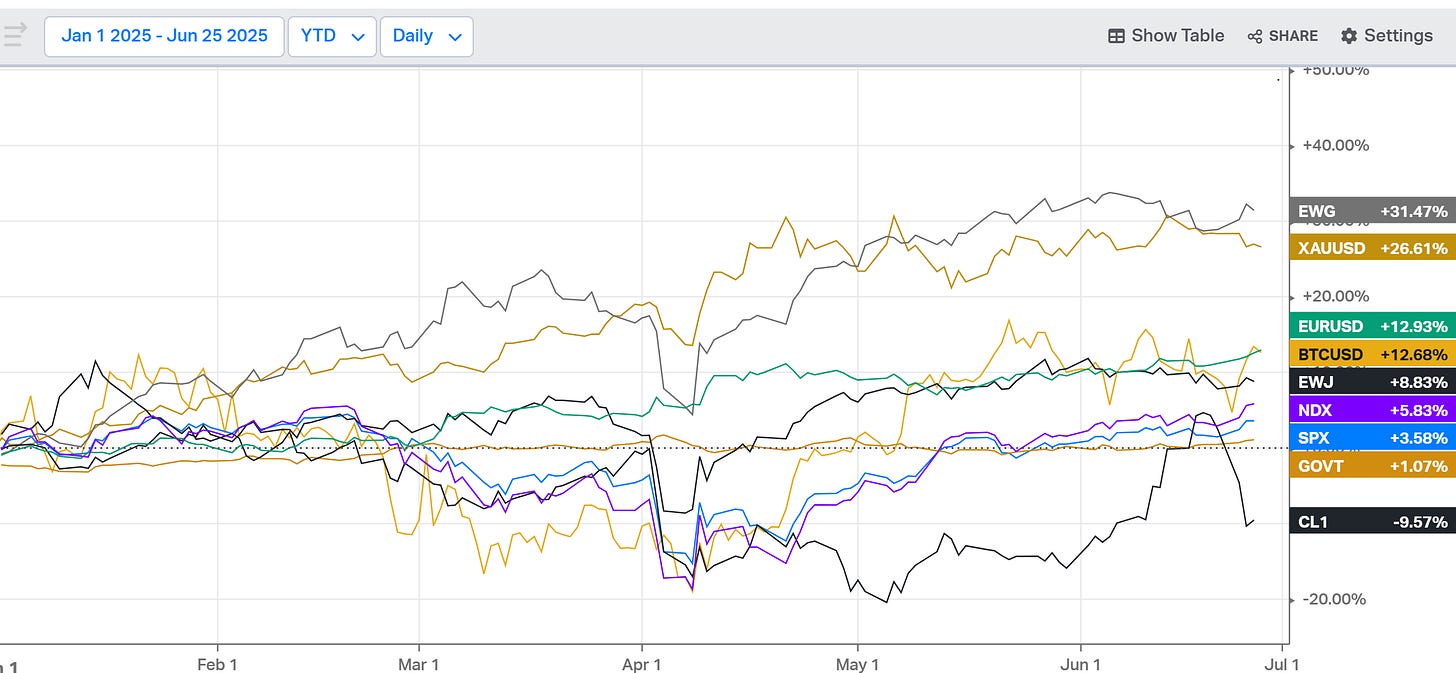

Starting with a recap of markets below, we see that bitcoin:

Leads all assets higher yesterday, and is:

The third best performer YTD after gold and non-US equities and,

Leads all others based on a 5-year compounded annual return.

What is NOT shown is the volatile path that many assets have taken YTD, oil in particular.

Oil has roundtripped a 15%+ move in June, moving from a 13% YTD loss to a 5% gain, before dropping back to a10% YTD loss after middle east concerns abated.

This post touches on events accelerating the move toward Bitcoin and tech-native solutions (Stablecoins, social platforms), as legacy institutions either adapt or fade.

Fresh from the BTC Prague conference, and now traveling through Bratislava, Budapest, and now Vienna, I’ve seen firsthand how boundaries, power, and value shift over time.

Trivia: What’s the fourth most visited city in Europe after London, Paris, and Rome? Drop your guess in the notes. The answer ties directly to this investment thesis.

About This Substack

This newsletter has two parts:

The Macro Frame (free): Market, geopolitical, and cultural dynamics that highlight Bitcoin's growing relevance.

The LEDGER (paid): Data-rich analysis and investment insights for those building conviction in this thesis. For an overview, see "Can’t You See."

We’ve Seen This Movie Before

In the Vietnam era, Walter Cronkite's nightly broadcasts shaped national opinion. In 1991, CNN transformed the Gulf War into live, watchable theatre.

But this weekend broke the script.

The first news of the U.S. bombing in Iran didn’t come from official briefings—it came via Trump’s Truth Social. Information is now disintermediated by platforms, not pressrooms. Not decentralized. Just unfiltered.

This 60-year arc of media transformation mirrors Hemingway's “gradually, then suddenly”. Trusted gatekeepers haven’t eroded—they’ve vanished.

In their absence, platforms like X, Substack, NOSTR, and Truth Social compete to deliver news, narrative, and influence.

And it’s not just information that’s shifting.

Just as digital media challenged broadcast, digital money is reconfiguring how we store and transmit value. Stablecoins occupy the centralized lane. Bitcoin defines the decentralized one.

📘 Economics

Macro data: No major releases this week, but the economic backdrop remains steady. Inflation data suggests the Fed remains on pause, while slowing discretionary demand in China and the EU casts a shadow on global growth.

Japan’s higher than expected CPI print speaks more to the persistence of inflation globally than a headwind to Fed rate cut plans given Fed tools to manage rates and treasury issuance.

See SLR in the Player section.

U.S. labor: Softness continues to emerge. Jobless claims remain elevated, and consumer sentiment is mixed. These support the Fed’s patient stance.

📙 Markets

Stablecoins & Treasuries: An alignment of interests.

More Stablecoins = more buyers of U.S. Treasury Bills, at a time when treasury is issuing eight to nine TRILLION bills every four months.

The GENIUS Act mandates that Stablecoins be backed 1:1 with U.S. dollars or short-term Treasuries. This creates new marginal demand for U.S. debt and could have a modest yield-suppressing effect.

Digital Assets & Equities: Circle (CRCL) and Coinbase (COIN) shares rallied ~30% and ~17% respectively on the week. This reflects expected revenue upside from reserve management and issuance scale. In contrast, Visa (V) and Mastercard (MA) added to losses as the market assessed the disintermediation risk.

Bitcoin: Roundtripped from a $106k / 98k / $106k move in reaction to the U.S strike on Iran. Markets may be digesting the GENIUS Act implications alongside continued ETF flows into the U.S. spot ETFs as Eric Balchunas reported on X and share in The LEDGER further below for paid subscribers.

🏛️ Political & Regulatory

GENIUS Act passed Senate (68-30): Establishes Stablecoin framework (1:1 reserves, audits, consumer protection, bankruptcy priority). Now moves to House with strong Trump endorsement.

Texas Governor signs BTC custody bill: Authorizes state banks to offer custody and trading services for Bitcoin. This builds directly on the GENIUS Act, enabling real infrastructure deployment of digital assets by regulated banks.

🏦 Financial Sector

Winners: Coinbase (COIN), Circle (CRCL), bank infrastructure providers, and Treasury liquidity desks.

Worthy to note that Coinbase’s stock remains BELOW its 2021 IPO price. We are not suggesting the CRCL will experience the same fate, but caution for a competitive market is prudent. Noteworthy is today’s regulatory environment, which is materially different than the previous, with over 3 years to continue its unprecedented support.

At risk: Mastercard, Visa, and closed-loop payment networks that may face disruption from bank-issued Stablecoins.

💰 Bitcoin Players

Regulatory clarity is unlocking institutional demand.

Bitcoin commands a PERSISTENNT 60%+ of crypto market cap, attracting traditional players looking to invest intelligently.

State-level policies (TX, FL, TN) may serve as templates for broader adoption.

🤖 AI / LLM Players

Quiet week, but the energy-Bitcoin-data center nexus remains a macro theme.

Subscribe to The New Barbarians podcast (co-hosted with Bill Mann) for more on AI and digital assets.

YouTube clip: https://youtube.com/shorts/WcXwUHycZsw?si=lFLMq4UJ-CqPhJMo

Subscribe: https://www.youtube.com/channel/UC554Pf2IwWZpJ277_ndL1NA

“Changing of the Guard”

Legacy banking and legacy media are losing ground to digital-native firms.

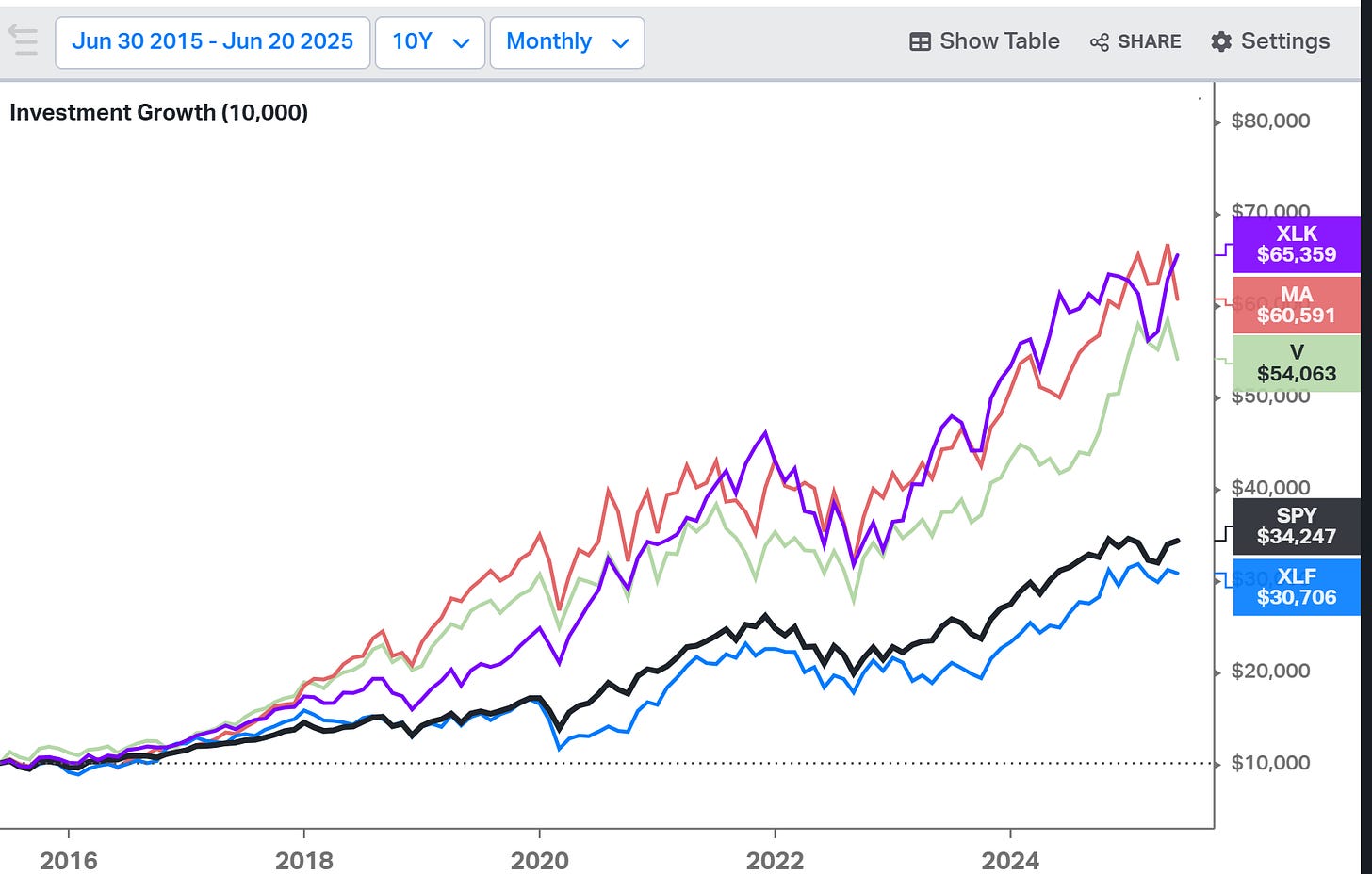

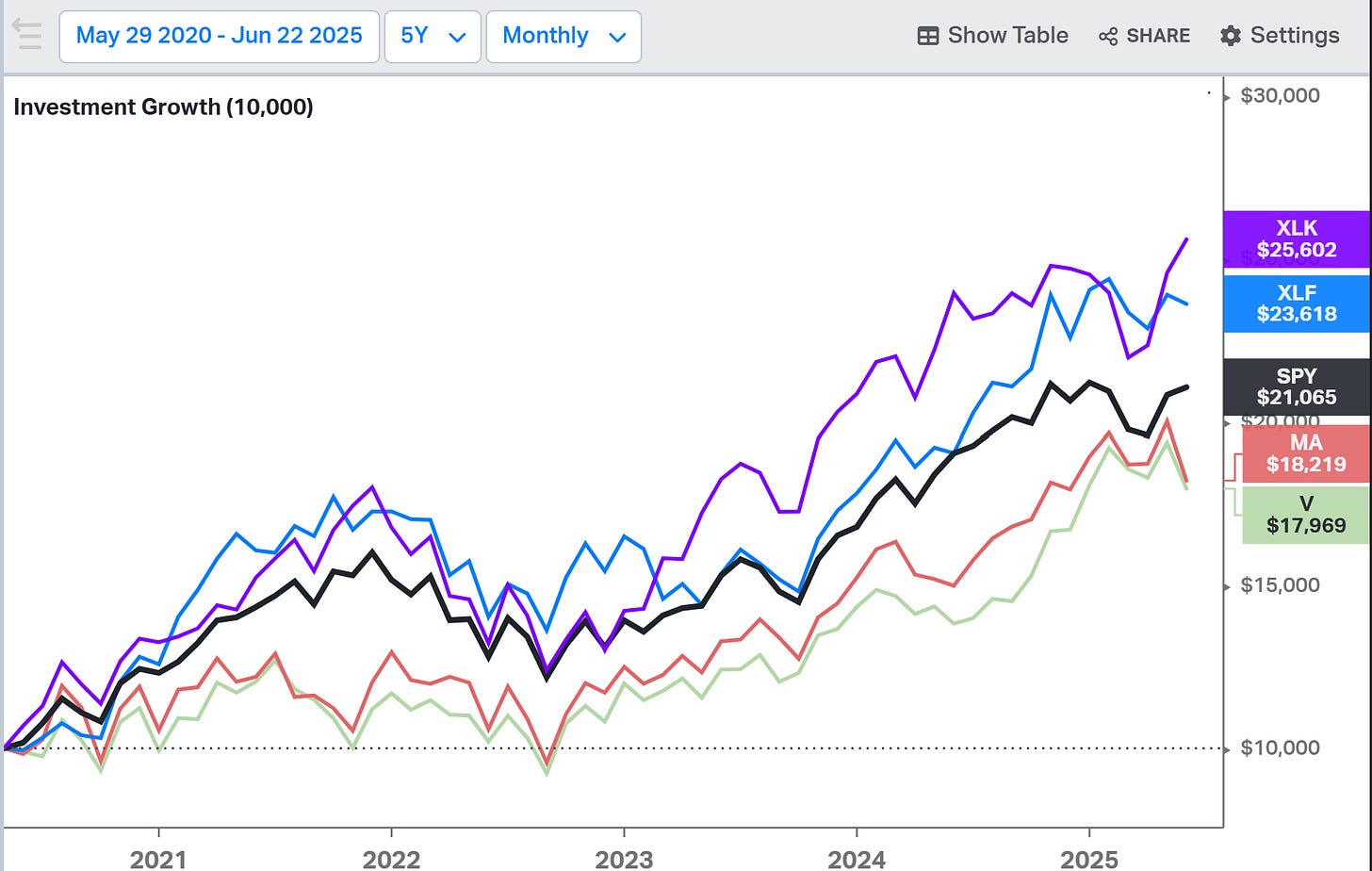

Visa and Mastercard outperformed banks and the S&P 500 over the last 10+ years. But that edge is fading. Tech scaled them. But it won’t save them.

Recent underperformance suggests the next disruptors are here.

“Running Circles Around TradFi”

Circle (CRCL) has gained 600% since its $31 IPO earlier this month.

But IPO access matters: those who bought at $83.23 (first daily close) earned half that.

Bitcoin, by contrast, has outperformed for 5, 10, and 15 years—with no need for insider access, a brokerage account, or even a bank.

These two firms scaled with technology, not bank branches. But apparently, that was not enough as their performance has lagged over the past five years as shown below.

The graph below explains June’s sharp decline for both MA and V and who the next disruptors are.

Keep reading with a 7-day free trial

Subscribe to The Macro Case for Bitcoin to keep reading this post and get 7 days of free access to the full post archives.