Bread, Circuses, and Discord

Political Instability Rises With Unemployment. Nepal as the Cautionary Tale.

“We Won’t Get Fooled Again” - The Who, 1971

TlDr; Idle Hands Can Still Vote

Today’s post is long, so muscle through the dire realities of our geo-political and socio-economic state to the nuggets of opportunity shared towards the end for the college grad and cubically challenged job hopper alike.

Nepal’s tech-supported coup is a cautionary tale for governments about what happens with idle hands and too much debt.

Today’s expected Fed rate cut announcement is a distraction from continued damage of money printing and deficit spending.

Investment and employment opportunities exist in AI and Bitcoin related businesses and adoption. See Event & Opportunity section at end where we offer steps to ImagineIF instead of idly wondering why.

One such opportunity arose for our new analyst, whom I met at btcPrague in June. See his handiwork here in our Economic Calendar which distills this week’s 200 economic releases into 3 for each region.

The Who’s frontman Daltrey sang the above lyric in 1971, a time of high unemployment, war and general economic malaise. This rise in unemployment & interest rates shattered trust between governing bodies and the younger generation.

August’s rise in overall U.S. unemployment — including a net decline in government jobs — is likewise fomenting mistrust.

How can equity markets be at all-time highs while jobs are declining?

If the Fed has been cutting interest rates for over a year, then:

Why are credit card rates still 25–33%?

Why is home affordability at record lows?

Why is wage growth still lagging life’s real costs, most of which are not captured in CPI?

Just like Daltrey’s generation, today’s markets are not getting fooled again.

Investors have already shifted focus to scarce assets that hold value as governments inefficiently throw debt at structural issues of Debt, Deficits and Declining Demographics.

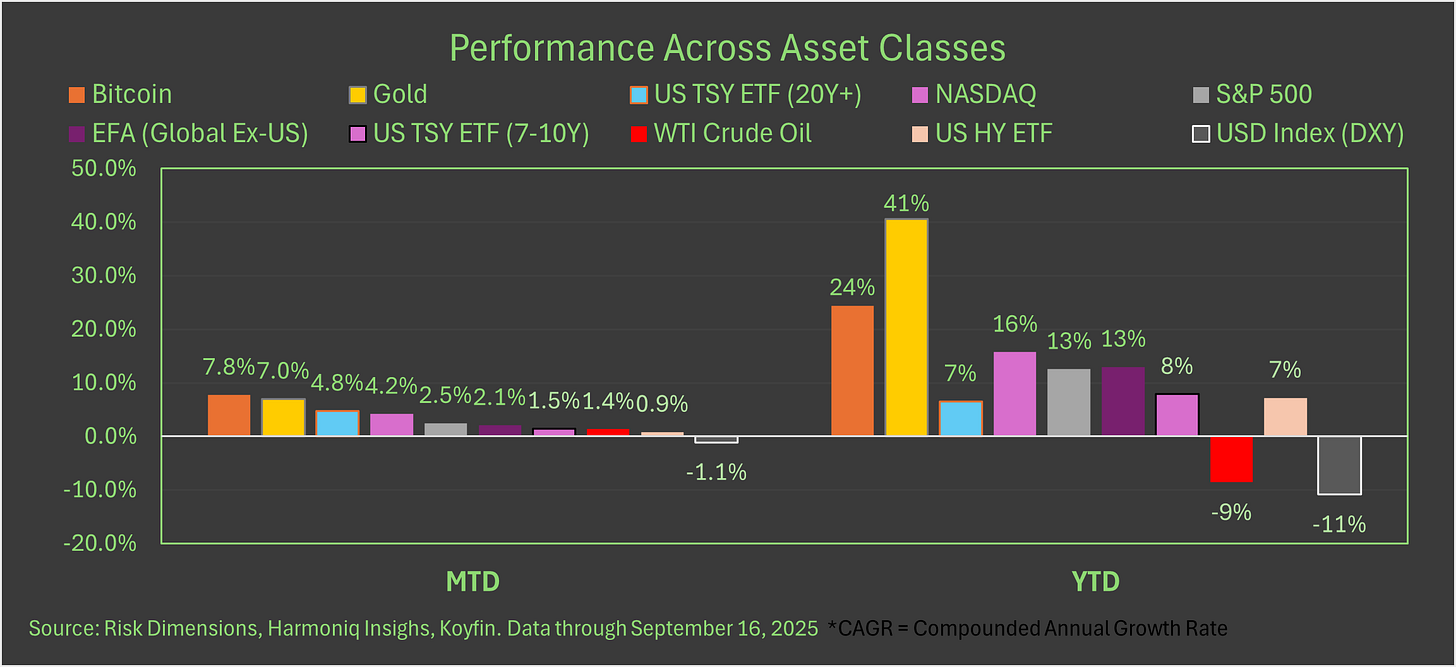

This is why YTD gains for gold (41%), bitcoin (24%) and silver (+43%, not shown below) lead all asset classes. Because it is the SUPPLY of money, not the price of money that is driving markets. And more supply is coming.

Investors see a lot more government spending, as MTD leadership follows the YTD and one year trend (not shown).

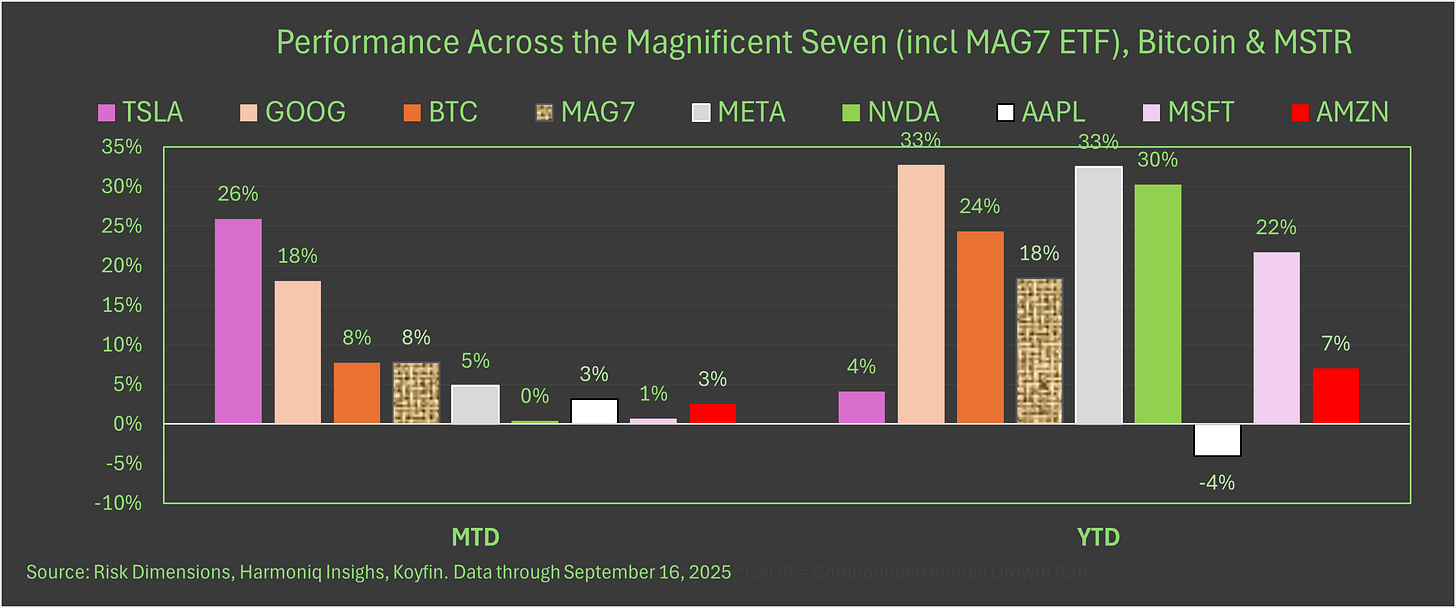

Large cap tech equity leadership is asserting again in September after a brief hiatus in August. TSLA’s 26% MTD gain to over $420 is a cosmic wink at the bizarre state of our markets and culture that links Elon’s personal success and board approval to his then controversial appearance on Joe Rogan’s podcast where he smoked marijuana.

“What about us? What about all the times you said you had the answers?” - P!nk, 2017

Last week’s overthrow of Nepal’s government reveals that the issues shared in June’s Debt, Deficits and Demographics post are not limited to the U.S. or G-10 counties.

The above quotes show that the scourge of broken promises and disaffected youth is also, unfortunately timeless.

In Nepal the disaffected youth revolted, maybe to avoid - in the words of Daltrey, being Fooled Again.

With youth unemployment already north of 20%, the Nepalese government tried to take away their last outlet — social media — leaving them with no jobs, no voice, and no sense of future. Within days, parliament was on fire, the prime minister was out, and a new interim leader was chosen not in back rooms, but on Discord (see LEDGER section for the full timeline).

Nepal’s median age of 29 and low per-capita income on a PPP basis (~$1,400 vs. ~$55,000 for the U.S.) exacerbated the sting of such high youth unemployment.

Different Zip Code. Same Problem

While many developed nations including the U.S., U.K., France, Germany and Japan have lower unemployment, older, less restless populations and higher per capita GDP, cracks in their political facades are emerging.

But, similar to Nepal, easy access to global debt markets may be limited, accelerating domestic unrest.

Revolving Doors of Government

French Prime Minister, Francois Bayou’s call for austerity cost him his job earlier this month as the government collapsed. Incoming PM, Sebastian Lecornu will be the SIXTH French Prime Minister in five years. A turnover rate that is more than 2x Nepal’s

Yes, Macron is still in power, and for good reason. The French PM is the circuit breaker, dealing with the practicalities of funding and running the domestic government. Macron handles other aspects, including foreign policy, not the growing issues of funding entitlements for an aging population.

But the French government is not alone in experiencing more volatility.

The U.K. and now Japan have had four PMs since 2020, and Germany three. Japan’s PM Ishiba stepped down earlier this month ahead of a likely ouster.

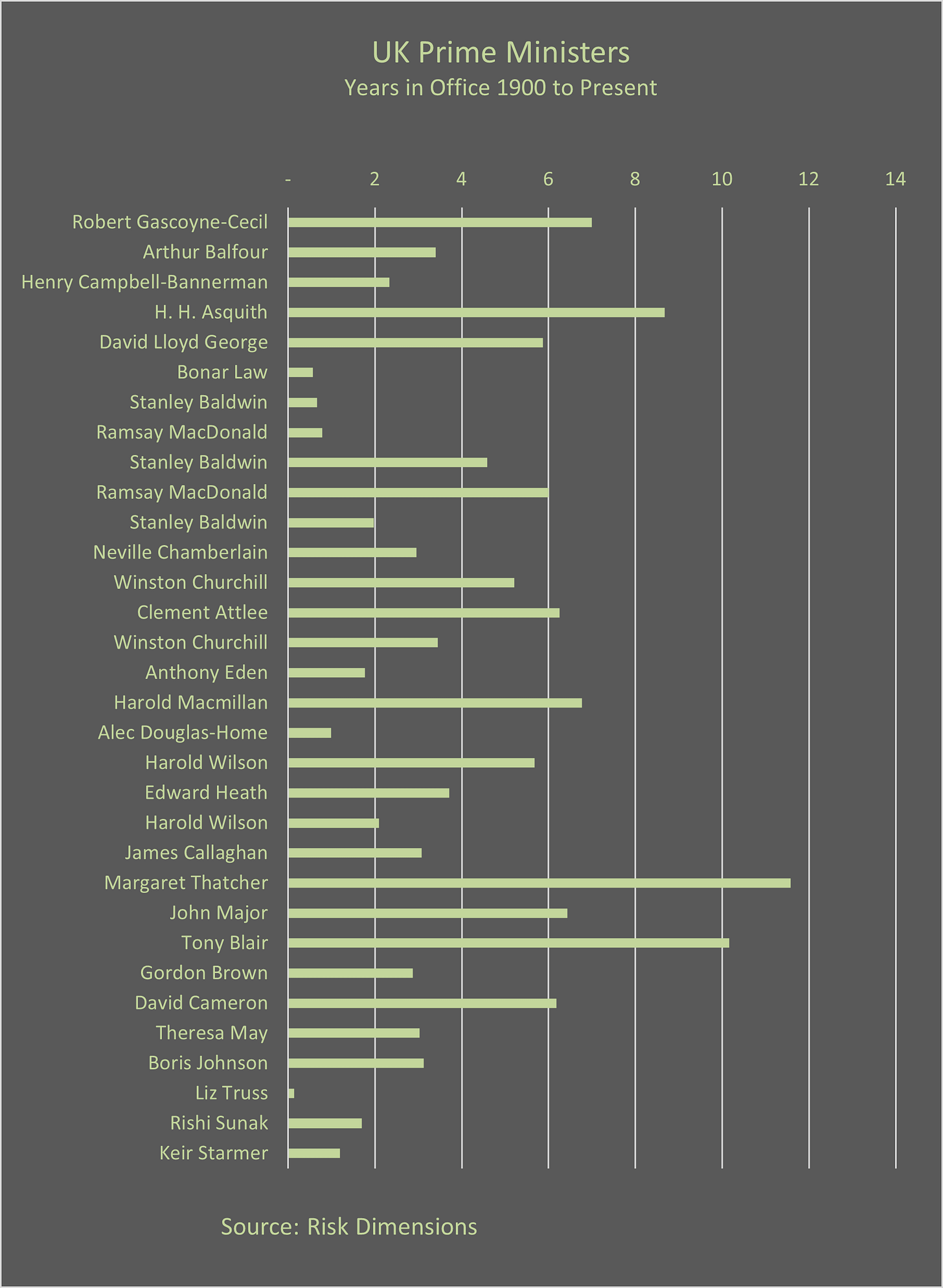

Focusing on the U.K., where the Prime Minister’s role as head of state and head of government is more critical than the French PM’s., we see a steady decline in tenure since the stormy days of fiscal reconstruction under Thatcher.

This current trend is similar to the period between The Wars, from 1918 to 1940, when three of the six U.K. PMs, Law, Baldwin & McDonald didn’t last a year.

During this period (1918 to 1940) each of the U.S., U.K. France, Germany and France leaders experienced the shortest average tenure relative to the average tenure during the pre-war or post-war periods, using 1940 as the line of demarcation.

The economic parallel is related to money. After fighting WWI, these countries dealt with a global pandemic, leaving many countries indebted…similar to today.

When looking at U.S. Equity markets that are at all time highs and the global EFA ETF up 13% YTD, all appears well for equity investors.

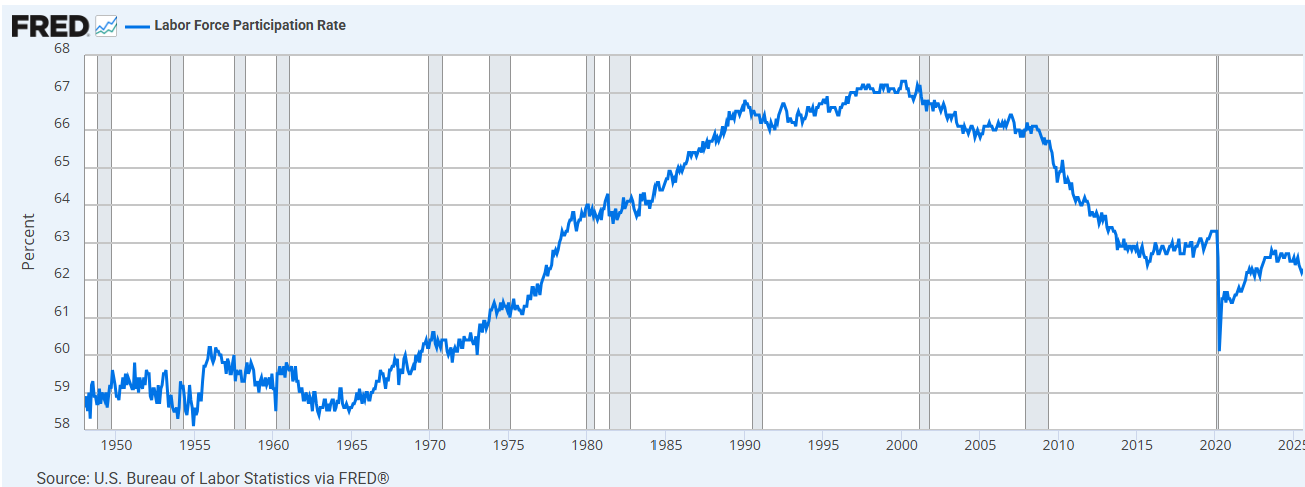

The same can not be said for the wage earner. Rising unemployment is even worse when you consider the declining rolls of people looking for work as measured by the U.S. Employment Participation Rate (62.3).

A Charade of Certainty

In our August 22nd Post, The Third Mandate, we shared how the Fed has changed their process over the years in what seemed to be a chaotic shuffling of processes and systems.

But even chaos theory assumes certainty in the starting point a.k.a. initial conditions. In today’s markets, we don’t have initial conditions as data is revised, inflation mis-measured & debt understated. With Lorenz’s 1960 study of weather at MIT, it took just a butterfly’s wingbeat to disrupt the forecast, today’s central bankers can’t even agree if the butterfly exists.

“All roads lead to inflation” - Paul Tudor Jones, October 2024

The Fed insists it can thread the needle — lowering rates to keep growth alive, despite tariffs and deficit spending pushing inflation higher. But needles are narrow, sharp and difficult to negotiate - especially for a Fed whose deft hand has been compromised by the distraction of a debt-induced, shadow third mandate.

A Yield Curve That Won’t Cooperate

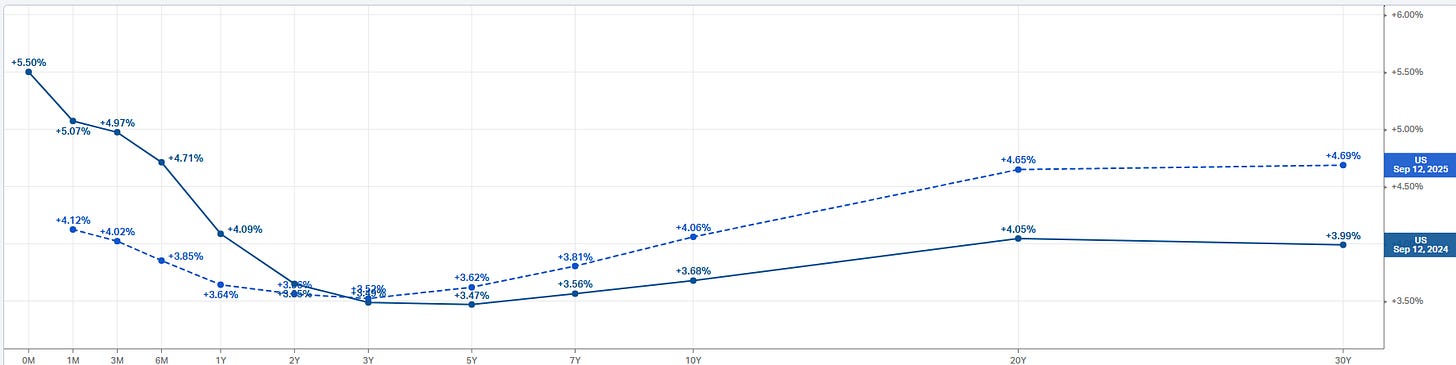

The Fed already cut the Fed Funds rate 100BPS in 2024 and the market revolted, pushing up the UST 10Y over 100BPs last September, to over 5%. Today’s level of 4.06% (dotted line) is still higher than last September’s 3.86%, before the 50BP cut.

This is why the Fed will eventually come in again and likely buy Treasuries to dampen the rise in rates from the growing supply of Treasuries, now being issued at a rate of $1T every 2 months.

While the Fed pushed the Front end lower…the market lifts the long end in revolt.

Global Rates: One Water Table of Risk and Reliance

“When we try to pick out anything by itself, we find it hitched to everything else in the Universe.” - John Muir, 1892

Global G-4 yield curves are now upward sloping as shown in the below sample.

This is ‘normal’. Normal because longer rates have ‘term premium’ priced in. Term premium pays investors for inflation (loss of buying power), interest rate uncertainty and now credit risk that can manifest during the time of any loan.

Time is money and these sovereign yield curves reflect how markets price the cost of lending of money over time.

But we are NOT in normal times, so setting the price for the shortest of interest rates has become more complex, a financial game of Jenga for the Fed given:

growing interest expense from the explosion in U.S. debt, now compounding at 13% annualized rate since the July debt ceiling was raised.

So raising rates may help fight inflation, but the costs of interest expense are now driving the deficit even wider. This result is ALSO inflationary.

competing policy interests across sovereigns.

the interconnectedness of markets as discussed below - Chaos Theory in practice

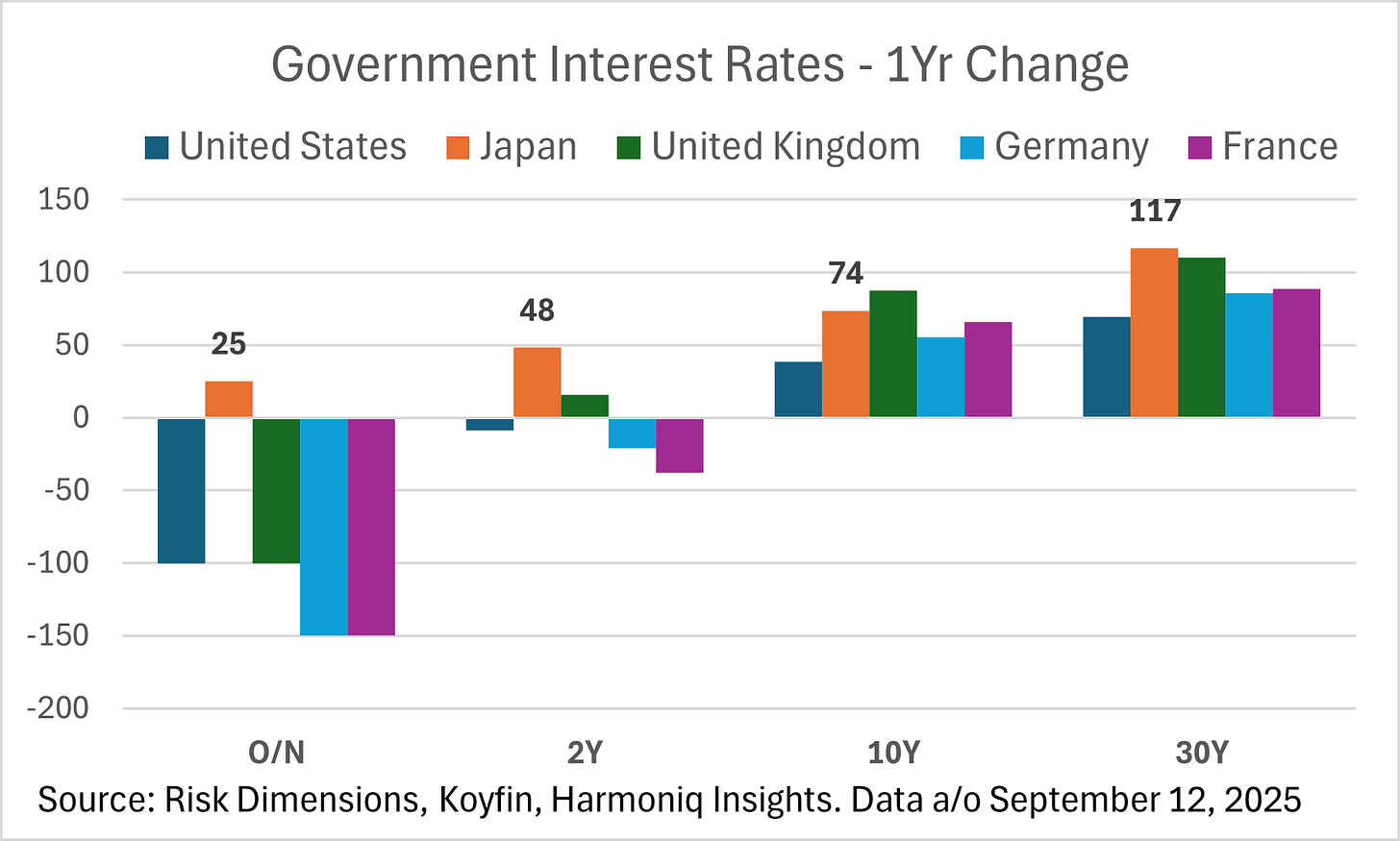

The differences in sovereign rates are greatest at the front end of the yield curve, reflecting different growth profiles and policy objectives. Changes in the overnight rates can lead to major market disruptions as we saw in July/ August of 2024 when the BoJ raised rates to stem losses in their failing Yen.

The result? A sharp reversal in the Yen (a desired outcome) and a 9.7% one day decline in the Nikkei, the largest since Black Monday in 1987. A NOT desired outcome.

This was caused by leveraged players exiting a popular ‘carry trade’, borrowing cheap yen to buy stocks, including the Nikkei. That trade reversed in grand fashion in early August when the BoJ raised the cost of borrowing.

Below we see four of the five major central banks cutting rates over the past year. But all of them have seen rates move higher in the 10Y and 30Y points.

Given the interconnectedness of markets noted above, we expect more volatility as differing policy objectives drive unintended consequences as we saw with U.K. Prime Minister Liz Truss’s short tenure in 2022, the U.S. and Credit Suisse bank failures of 2023 and the failure of the French and Nepalese governments this month.

Markets Brief

From dopamine hits to sober signals:

Last week the contrast couldn’t be clearer: Wall Street engineered its own dopamine highs and meaningful successes with digital asset IPOs and Nasdaq’s splash into tokenization, while Main Street companies like Ford, GM, and Best Buy slashed earnings under the weight of tariffs and weak demand.

Meme Stocks - A listed equity that provides a strong dopaminergic response to gains or losses. Its about the community engagement, less about the investment, notwithstanding some successes like roaring kitty’s with GME.

Two of 2025’s top MEME stocks have delivered such dopamine in different

Open Door (OPEN, $9.42), +106% MTD, + 475% YTD, -27% 5Yrs

Krispy Kreme (DNUT, $3.23), -70% MTD, -57% YTD, -84% 5Yrs

Open & Dnut: momentum trades spiking on hype, the kind that fade fast but make headlines.

Nasdaq’s $50mm RWA bet: not noise, but infrastructure — a statement that tokenization is a long game.

Gemini & Figure IPOs: Wall Street collecting healthy fees while early buyers bank profits.

Tether’s U.S. stablecoin plan: less about product, more about politics, with Trump-world fingerprints all over it.

The surface pop of Meme Stocks is exciting, but the promise of digital assets and bitcoin enduring. The signal is clear: institutions are positioning themselves to monetize digital rails — not just dabble.

Keep reading with a 7-day free trial

Subscribe to The Macro Case for Bitcoin to keep reading this post and get 7 days of free access to the full post archives.