April’s turmoil continues this A.M. as President Trump states that ‘Powell’s termination cannot come fast enough!’.

But instead of rehashing current events, we invite readers to take a step back with this revised version of my March 2024 Substack debut—updated with sharper insights, LLM-assisted framing, and a string of market developments that continue to prove the thesis correct: most investors are flying blind in a system on borrowed time.

“Can’t You See?” is more than a southern rock anthem—it’s a question that defines today’s markets. Investors are staring at a debt-fueled system, blinded by legacy metrics and guided by heuristics that no longer work. The U.S. financial system is in checkmate…They just don’t know it yet.

The Marshall Tucker Band (MTB) asked it plainly in 1973: "Can’t You See?" Today, that question feels more urgent than ever. Despite the warning signs all around (gold & bitcoin +40%, DXY, -6.0% over the past year) most investors remain anchored to a financial system that’s already lost. They just don’t know it yet.

The same year MTB unleashed “Can’t You See”, behavioral psychologists Daniel Kahneman and Amos Tversky explained why. In their seminal 1973 paper on the Availability Heuristic—and later, in Thinking, Fast and Slow—they revealed how most decisions are driven by emotion, instinct, and mental shortcuts. Kahneman called it System 1 thinking: fast, intuitive, but error-prone. Rational analysis—System 2—exists, but rarely takes the wheel.

And that’s a problem, especially in markets. When the rules change, but your instincts don’t, you're left making outdated decisions on a board you no longer understand.

Don't Move Until You See It

Twenty years later, the 1993 film Searching for Bobby Fischer offers the perfect metaphor. A young chess prodigy, paralyzed mid-match, finally sees the winning line—but only after clearing his mind of emotional noise and visual clutter. His coach’s mantra? “Don’t move until you see it.”

This is how System 2 wins: it restrains impulse, allowing clarity to emerge. Most investors today haven’t cleared the board. They’re still playing yesterday’s game.

The Terminal Problem in TradFi

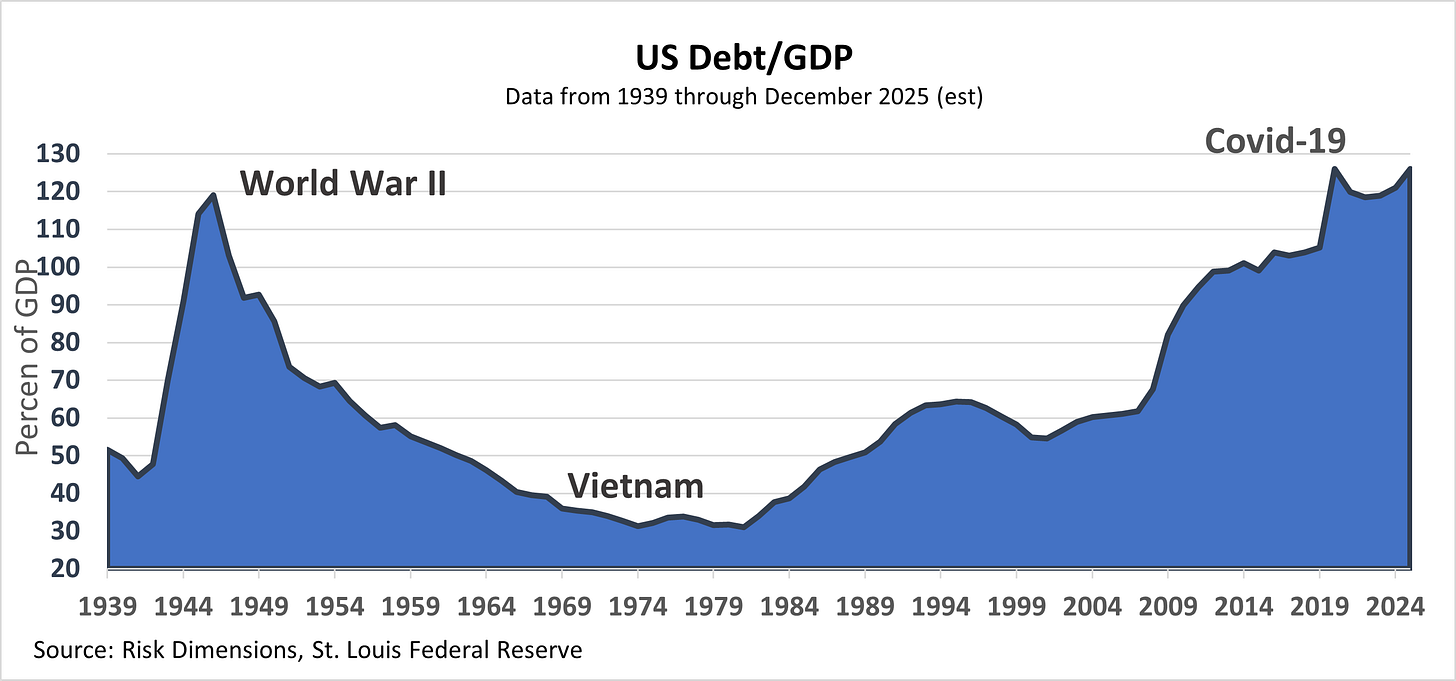

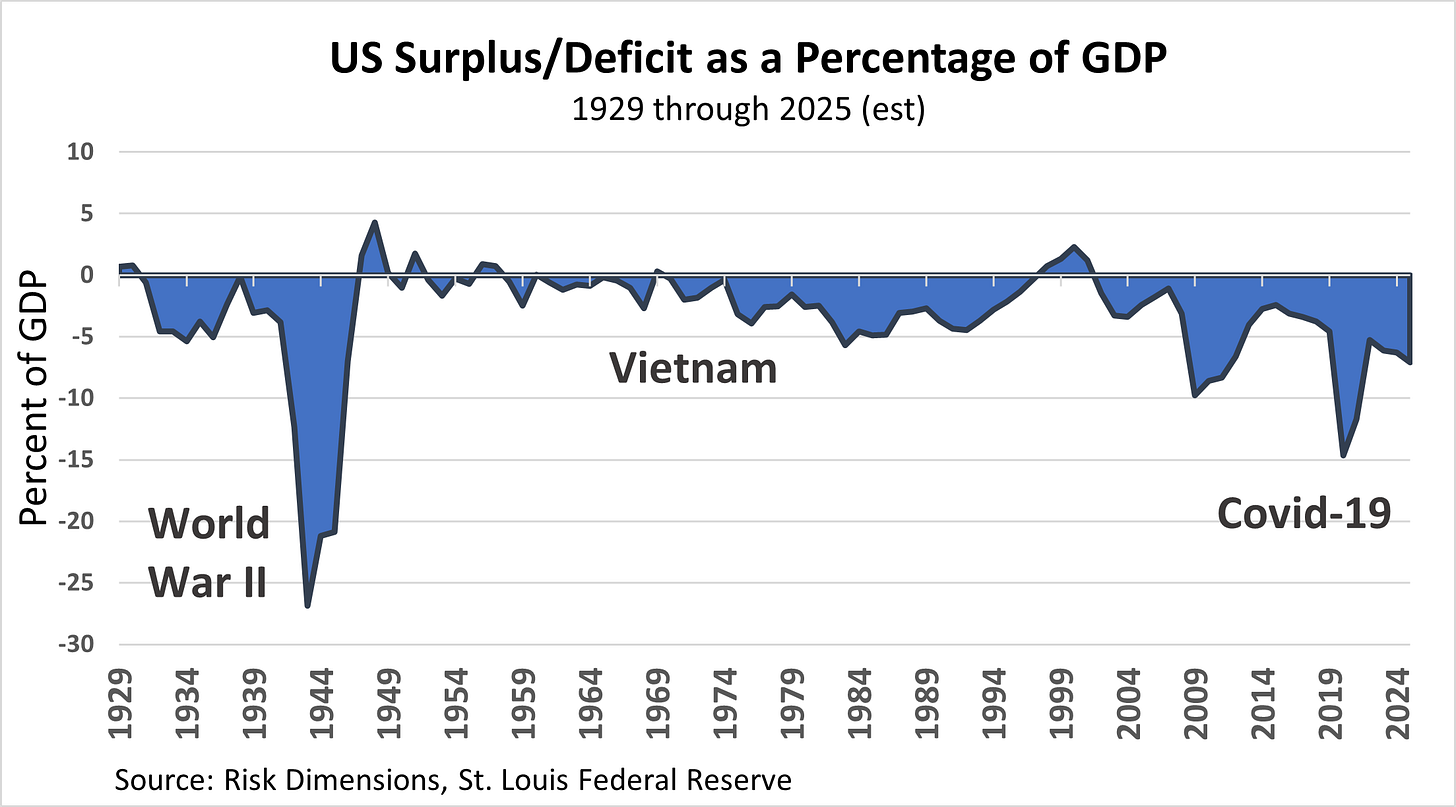

Here’s what they’re missing: the U.S. financial system is on an unsustainable path, functionally insolvent. Powell said as much in yesterday’s address at the Economic Club of Chicago.

· Debt has surpassed $36.2 trillion, growing by $1 trillion every 100 days.

· Interest payments are accelerating as low-yield debt refinances into 4%+ territory.

· Short-term debt now accounts for 35% of total obligations, up from 29% pre-Covid.

This deficit spending is not a recession response. It’s happening during full employment and positive GDP prints. Deficit spending is now structural, not cyclical. In 2024, we ran a larger deficit than 2023, same for 2022—despite a strengthening economy.

Wartime Finance

A Fed-Dominated, Fragile System

To plug the gap left by overregulated, risk-averse banks, the Fed has stepped in:

· Pre-GFC, the Fed accounted for ~12% of M2. post Covid, as much as 41%.

· Quantitative Tightening (QT) events (2008, 2019, 2023) all triggered market dysfunction.

· The MOVE Index which measures US Treasury volatility, hit 199 in 2023—higher than Covid levels. Last week it hit 139, well above its long term average of 90.

This is centralization by necessity, not design. But it’s left the financial system fragile and less adaptive. Volatility in money supply is increasing, while trust in fiat is decreasing.

Anchoring Keeps You Blind

Most investors still trust the labels: AA-rated, G7, investment-grade. But these are legacy signals, false flags of security. Anchors to a past regime. Kahneman warned us about this too: our judgments are subconsciously tied to familiar reference points—even when they’re no longer valid.

To see clearly, we must clear the board.

Bitcoin as the Remedy

Unlike fiat, Bitcoin can’t be debased. It doesn’t require trust in central actors. And over time, its volatility is declining. Where fiat money grows more chaotic, Bitcoin is becoming more stable.

· Its issuance schedule is fixed.

· Its ownership is decentralized.

· Its security (hashrate) continues to grow.

It’s the antithesis of TradFi: permissionless, transparent, and not subject to political discretion.

Bitcoin rewards long-term preference—exactly what the U.S. Treasury sacrificed by issuing short-dated debt to solve a long-term problem. Like the Marshmallow Experiment, those who wait, win.

You’ve Lost. You Just Don’t Know It Yet.

System 2 thinking invites clarity. It forces discipline. It urges us to pause, look again, and clear the board.

That’s what this Substack The Macro Case for Bitcoin will do—clear the board, so you can see what comes next.

Because the old system is already lost.

You just don’t know it yet.

__________________________________

The LEDGER

Additional source data in support of our investment thesis

It took over 218 years for the U.S. Federal Government to accumulate $10T in debt…but just 15 years to issue an additional $25.5T.

U.S. Debt has more than tripled since the 2008 Global Financial Crisis (GFC), Data from the U.S. Treasury through FY 2024 (Sep 2024).