Two of the largest equity market reversals in decades occurred Monday and Today, indicating market uncertainty has only increased since April 2nd’s Liberation Day tariff announcement.

Its been just four trading days, but feels like 40 days, and for good reason, the moves in equities have been historic but it is the failure of U.S. Treasuries and even gold to act as safe havens that is the main story.

Our Markets Scorecard shows that the year-to-date and one-year gains in Treasuries and gold have reversed in April. All major asset classes are now down month-to-date.

This broad-based decline points to one thing: deleveraging, including in the U.S. Treasury market.

When investors sell assets financed on margin, the cash received is less than the full sale proceeds—because some of it was borrowed. That creates forced selling pressure.

This dynamic helps explain why safe havens aren’t catching bids: more assets are being dumped than there is cash to absorb them. So the proceeds go to pay down margin debt, without any chance of being channeled into gold.

Deleveraging spirals like this can become self-reinforcing.

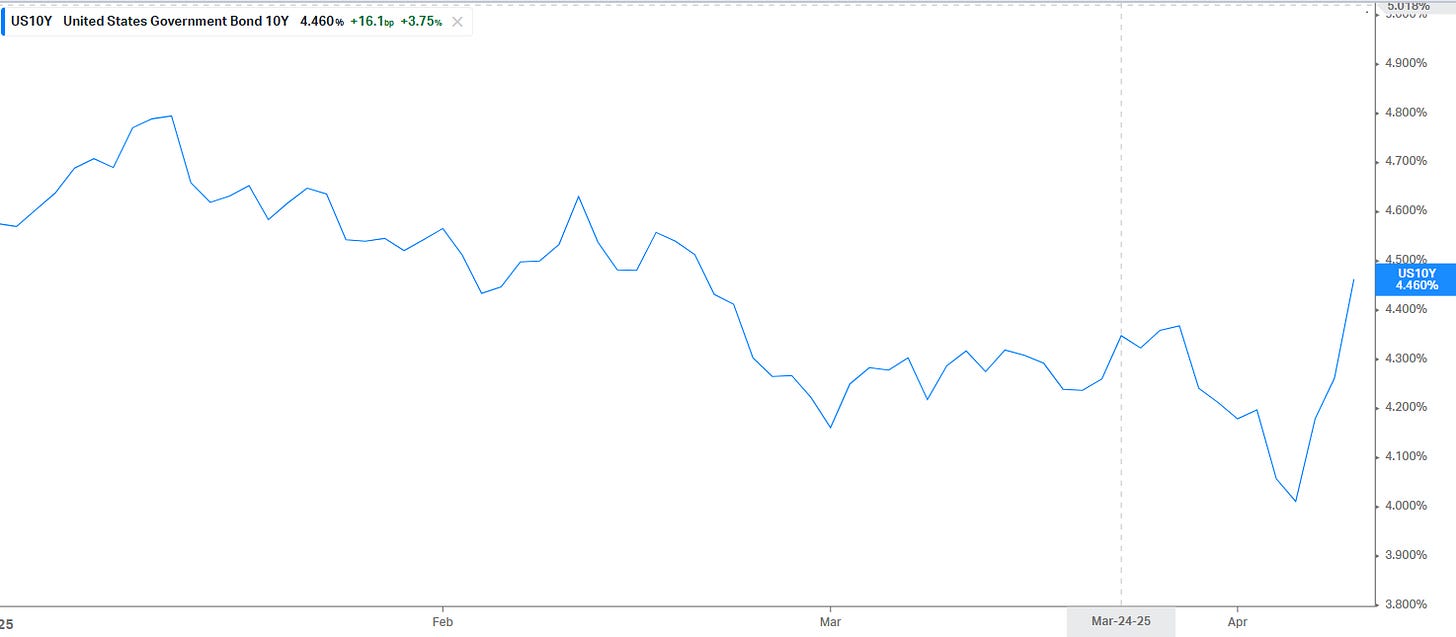

The Treasury selloff began on Friday, April 4. Yields have surged more than 50bps from the 3.86% low—just as Treasury Secretary Scott Bessent tries to manage ballooning interest costs.

Higher yields also raise the bar for Fed intervention. Powell & Co. are unlikely to step in lightly. The potential stoking of inflation by a Fed responding too quickly would undercut Powell’s legacy.

But if stress deepens, Powell will act—and not just by cutting rates.

Keep reading with a 7-day free trial

Subscribe to The Macro Case for Bitcoin to keep reading this post and get 7 days of free access to the full post archives.