“An invasion of armies can be resisted, but not an idea whose time has come.” - Victor Hugo

When President Nixon cut the gold thread in 1971, the fabric of monetary integrity began to fray. Each subsequent patch — the petrodollar, the techno-dollar, sanctions — bought time but not trust. Proof-of-work exceptionalism gave way to scaffolding for a reserve currency that had lost its foundation.

But August 15th, 1971 marked more than the end of the Gold Standard. It closed the curtain on Pax Americana — a brief generation of unipolar order built on the familiar bedrock of a gold standard.

The gold-backed U.S. dollar system was designed in July 1944, when 44 nations gathered in Bretton Woods, New Hampshire. Their aim was nothing less than a new monetary order to fund a new global order. The first task: rebuild Europe and Japan with the world’s first coordinated reserve currency, one that placed the United States in charge militarily, monetarily, and politically. Bretton Woods channeled gold, credit, and military might through Washington, giving rise to a unipolar world. It was not the first. The only question is — what will be the next?

*Many Allied nations had already shipped their gold to North America via Operation Fish for safekeeping. This left the U.S. holding 2/3rds of the gold reserves across all 44 Bretton Woods signers by the end of WWII. Nixon’s August 15th 1971 declaration ensured the gold remained on U.S. soil. America’s privilège exorbitant was not enough to supports its guns and butter policy, no choosing confiscation.

Money & Power

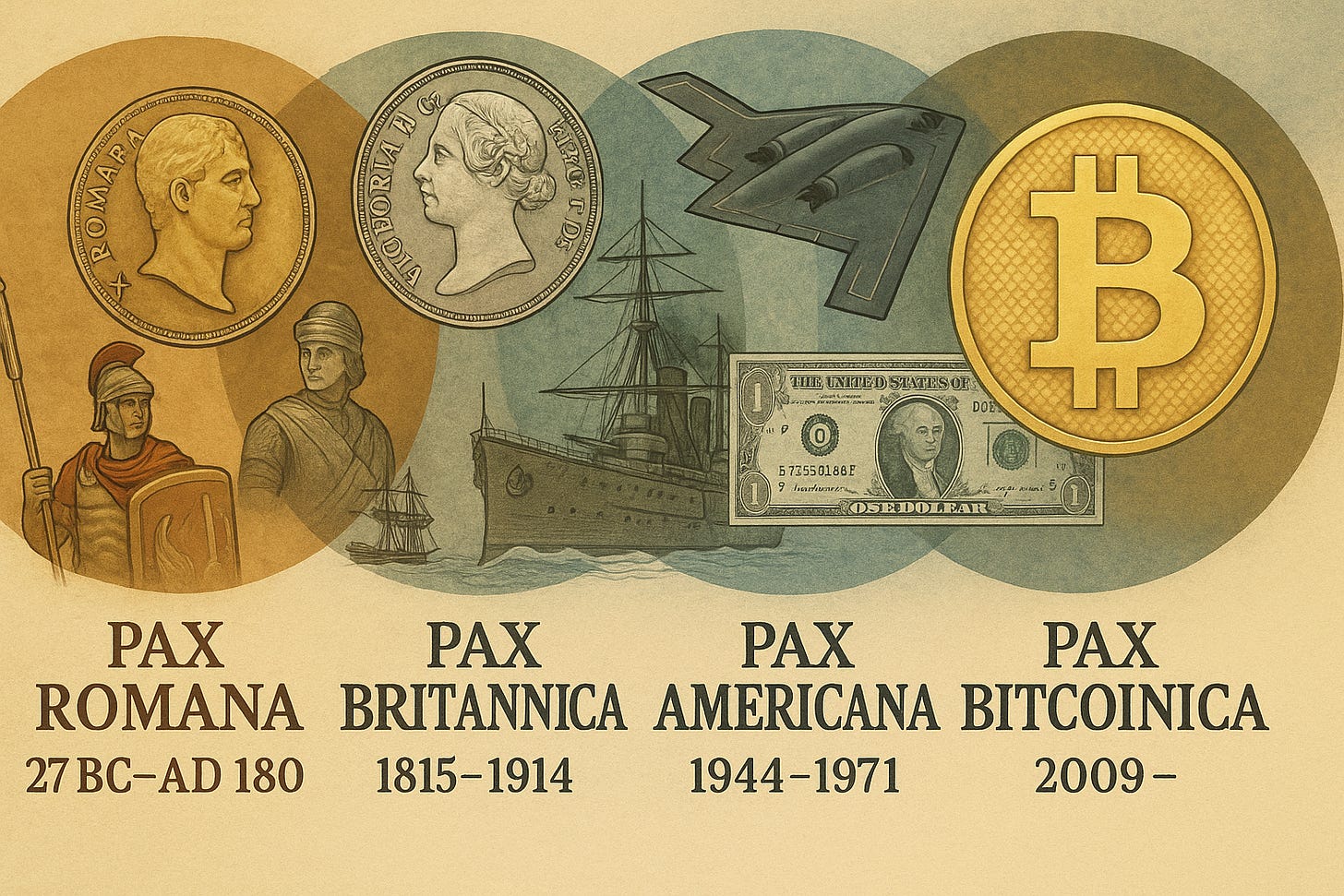

Rome’s peace was enforced by legions on land — the first global unipolar power. Britain’s by naval supremacy — nearly unipolar at sea. America’s by a gold-backed dollar and air power — for a generation of dominance.

But after 1971, Pax Americana slipped into something less solid: less peaceful, a hegemony enforced by debt, oil, and financial plumbing. Not the certainty of rules, but the weight of inertia.

Each of these Pax periods relied on sound money. For Rome, the silver denarius held sway for nearly two centuries. For Britain, the pound anchored global trade for about a century. For America, the gold-backed dollar lasted barely a generation — just 27 years from Bretton Woods to Nixon’s Sunday Night Massacre.

The burden of war and entitlements drained treasuries faster than they could be replenished. The answer? Debase the currency. Or, in today’s parlance: Money Printer Go Brrr.

Last month, the U.S. government added to the scaffolding of support for the U.S. dollar with passage of the GENUIS Act. By mandating Treasury-backed stablecoins, Congress has created a new base of buyers for America’s growing pile of debt. Another stitch, but not a new fabric.

Back to Sound Money, Peace & Opportunity

Can Bitcoin, enforced by code not conquest, underwrite a new era of relative peace? If so, will it outlast them all?

That question, however, isn’t only geopolitical. It starts with the individual.

I had planned for this post to focus solely on the destruction that followed Nixon’s Sunday Night Massacre. But a chance encounter last week in Nashville reframed it.

At Tootsie’s Orchid Lounge, an airport guitarist, Tristan Lockamy, asked for requests. I told him to play his favorite song. He chose If by Bread — a song I’ve always disliked. Yet his performance shifted it entirely. Same lyrics, new meaning. It reminded me of Johnny Cash’s haunting cover of Hurt. The song was originally written by Trent Reznor of Nine Inch Nails in 1994, but when Cash recorded it in 2002, his frail, time-worn voice transformed it. Reznor admitted, “Wow… that song isn’t mine anymore.”

That’s what happened in Nashville. The words didn’t change. The vessel did.

Bitcoin is like that. Value ferried on a network that is more integral and incorruptible than SWIFT. Emergent, unexpected — but undeniably better money.

Yes, Nixon’s action 54 years ago unleashed a decade of inflation, volatility, and loss. But the 1970s also offered more — if you were open to opportunity. While headlines obsessed over collapse, innovations were quietly remaking the future

Technology & Computing

Microprocessor (Intel 4004, 1971) – The birth of modern computing. Early adopters who saw its potential launched the personal computer revolution (Apple, Microsoft, IBM PCs).

Email (1971, Ray Tomlinson) – The first networked digital communication, foreshadowing the internet and the entire digital economy.

Ethernet (1973, Bob Metcalfe) – Created the backbone for local networking, essential to the future of office computing and the internet.

Microsoft (founded 1975) & Apple (founded 1976) – Both launched as microcomputers emerged, seeding fortunes for those who believed in PCs before Wall Street did.

🔹 Finance & Markets

NASDAQ (1971) – The first electronic stock exchange, paving the way for tech stocks and high-frequency trading.

Chicago Board Options Exchange (1973) – Expanded derivatives markets, enabling sophisticated hedging and speculation strategies.

Currency Futures (1972, CME) – Born directly from Nixon’s gold shock, creating entirely new trading profits as currencies floated.

All this while New York reeled from its fiscal crisis (“Ford to City: Drop Dead”) and BusinessWeek declared “The Death of Equities” in 1979 — just three years before the start of the greatest bull market in history began.

If — Poem, Not Song

Another If deserves mention. Rudyard Kipling wrote his poem If— in 1895, published in 1910, as Britain’s empire was straining under its own contradictions. It was counsel to his son: not to chase triumph, not to collapse in disaster, but to cultivate the character to endure both.

“If you can dream — and not make dreams your master;

If you can think — and not make thoughts your aim,

If you can meet with Triumph and Disaster

And treat those two impostors just the same:”

Kipling wasn’t promising wealth or happiness. He was charting the road to resilience. The poem insists that only through these tests can one inherit the earth.

The lesson is timeless. Triumph and disaster, like headlines and markets, are impostors. They obscure the truth, limit progress, and distract from opportunity. In the age of social media, these false flags multiply. But the task remains the same: fortitude in the face of noise.

Rome had its denarius. Britain its pound. America its dollar. Each unraveled. Bitcoin is incorruptible money, enforced not by armies or navies or presidents, but by code.

The future is already here — not evenly distributed, but waiting.

Got Bitcoin?

Paid Subscribers…

Can access the Ledger section with links to source data, videos and market commentary.

Are invited to join me on a Podcast next week (invite to follow) where I will address the risks and opportunities in today’s toppy market, inviting questions. Subscribers will also be given an additional invite to share with a colleague, friend…even a ‘no-coiner’ :-).

Keep reading with a 7-day free trial

Subscribe to The Macro Case for Bitcoin to keep reading this post and get 7 days of free access to the full post archives.