The Dual Mandate Under Pressure

The Federal Reserve’s dual mandate—maximum employment and price stability — has long defined its mission. But Powell’s Jackson Hole speeches since 2020 show not just shifting priorities between the two. They reveal something else entirely: a third, unstated mandate that increasingly takes precedence.

The review below of Fed Chair Powell’s speeches at Jackson Hole since August 2020 illustrate increasing variability related to their dual mandates, including

The Fed’s focus between these mandates of price stability and full employment.

The manner in which each mandate is measured and acted upon.

In short the Fed’s goal posts measuring success were not only moved, they were effectively REMOVED. The game kept changing because the Fed could not compete, as their policy kicks flew wide or fell short, rarely clearing the stated policy crossbar of success.

And markets are taking notice.

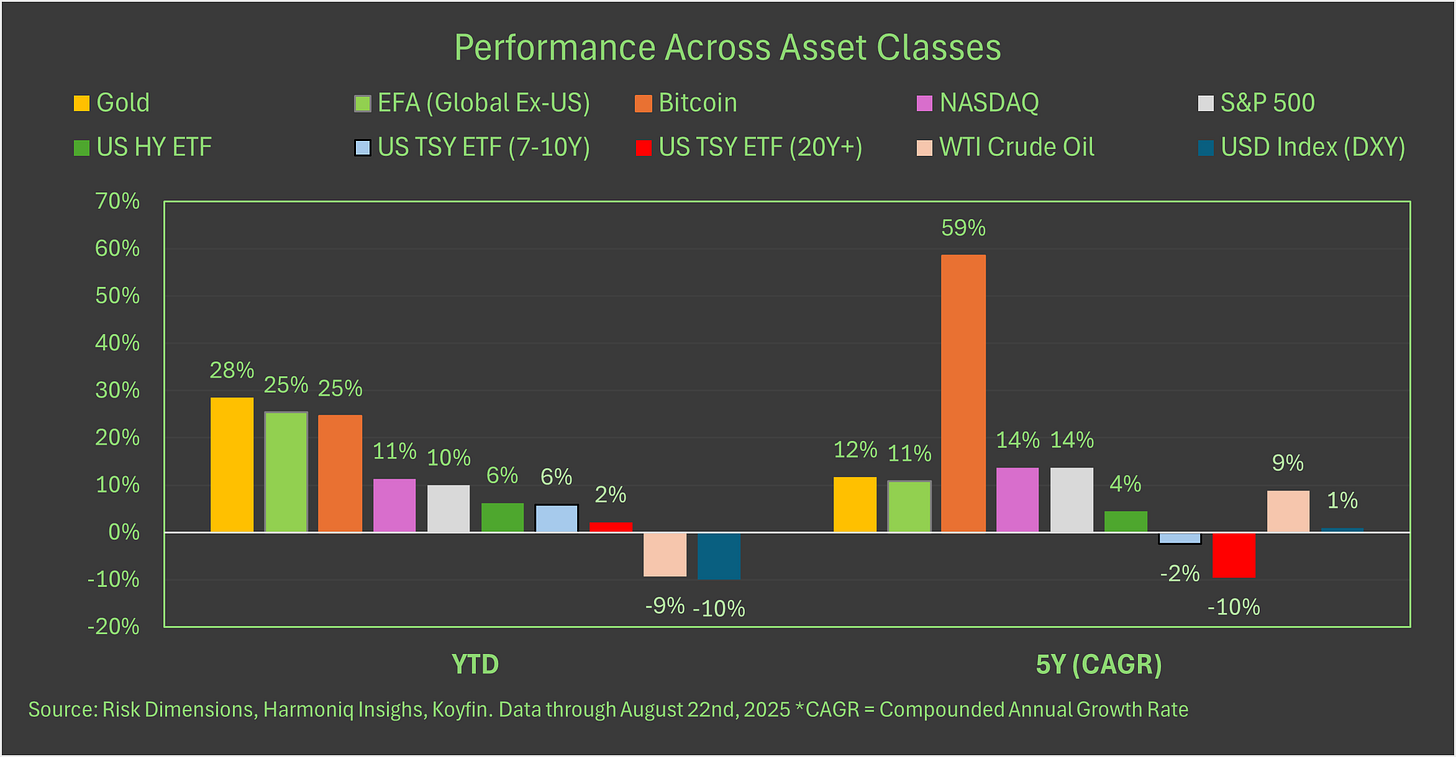

Markets are already voting on the Fed’s credibility. The top YTD performers—Gold, Bitcoin, and EFA—are macro trades, all driven by shifts in money, debt, and policy. Shifts AWAY from USD denominated assets.

Gold and Bitcoin have rallied on demand for scarce assets. EFA gained as the Trump Administration weakened the dollar. Meanwhile, U.S. Treasuries—supposedly the risk-free anchor—have been consistent losers over the past five years, compounding annual losses at -2% to as much as -10%.

Back to the Speeches…

August 2020: "New Economic Challenges and the Fed's Monetary Policy Review"

Focus: Heavily skewed towards maximum employment.

Context: The economy was still reeling from the initial shock of the COVID-19 pandemic, with unemployment having skyrocketed.

Message: Powell introduced a new framework of "average inflation targeting," signaling that the Fed would tolerate inflation running moderately above 2% for some time to make up for past shortfalls and to support a strong labor market recovery. The concern was deflation and a slow, painful recovery like the one that followed the 2008 financial crisis. Price stability was a secondary concern, with the Fed believing that the pandemic's disinflationary effects were a more significant threat.

August 2021: "Monetary Policy in the Time of COVID"

Focus: Acknowledging rising inflation, but still prioritizing employment.

Context: Inflation had begun to rise, but the Fed viewed it as "transitory," caused by supply chain disruptions and a shift in consumer spending from services to goods.

Message: Powell expressed confidence that inflation would subside as the pandemic-related distortions eased. The primary goal was to continue supporting the labor market's recovery, which was still far from its pre-pandemic strength. Tapering of asset purchases was discussed, but interest rate hikes were not on the immediate horizon.

August 2022: "Restoring Price Stability"

Focus: A hawkish pivot to price stability.

Context: Inflation had proven to be much more persistent and broad-based than the Fed had anticipated, reaching multi-decade highs.

Message: This speech was short, direct, and uncompromising. Powell stated that the Fed's "overarching focus right now is to bring inflation back down to our 2 percent goal." He acknowledged that this would likely cause "some pain to households and businesses" in the form of slower growth and higher unemployment, but that failing to restore price stability would mean "far greater pain." The dual mandate was, for the moment, a single mandate: fighting inflation.

August 2023: "Inflation: Progress and the Path Ahead"

Focus: A more balanced approach, but still with a clear emphasis on price stability.

Context: Inflation had begun to fall from its peak, but remained well above the 2% target. The labor market, however, had remained surprisingly strong.

Message: Powell noted the progress on inflation but stressed that the job was not done. He signaled a data-dependent approach, suggesting that the Fed could afford to be more careful in its policy decisions. While the risks to the two sides of the dual mandate were becoming more balanced, the primary concern was still ensuring that inflation was on a sustainable path back to 2%.

August 2024: "The Economic Outlook"

Focus: A notable shift back towards a more balanced dual mandate.

Context: Inflation has declined significantly, and the labor market is no longer "overheated."

Message: Powell's tone is more optimistic. He highlights the "fading" of pandemic-related economic distortions and the normalization of supply constraints. Crucially, he states that "the balance of the risks to our two mandates has changed," with the upside risks to inflation having diminished and the downside risks to employment having increased. This signals a greater willingness to consider the employment side of the mandate in future policy decisions.

August 2025: "Economic Outlook and Framework Review"

Focus: A delicate balancing act with the dual mandate in direct tension.

Context: The economic outlook is clouded by significant policy uncertainty, including higher tariffs pushing inflation up and tighter immigration policy slowing labor force growth. This creates a "challenging situation" with upside risks to inflation and downside risks to employment. The unemployment rate has risen by nearly a full percentage point over the past year.

Message: In what is expected to be his final Jackson Hole address as chair, Powell acknowledges the direct conflict between the two mandates. He signals that the Fed will "proceed carefully," with the stability of the labor market allowing for a cautious, data-dependent approach. He hints at the possibility of future rate cuts but offers no commitment on timing. The speech also announces a review and revision of the Fed's monetary policy framework, moving away from the 2020 consensus that focused heavily on the risks of near-zero interest rates, which proved ill-suited for the subsequent inflationary surge.

The "Shadow Mandate": Proper Market Functioning

While the dual mandate is the Fed’s official mission, its actions over the past five years reveal a third, unspoken mandate: ensuring the proper functioning of financial markets—particularly overnight funding markets and Treasury auctions.

If either of these fail, the U.S. government can not fund itself.

Hard to imagine, but the 2008 Global Financial Crisis (GFC) and the September 2019 U.S. Treasury Rep failure are examples of the previously unthinkable.

For weekly Updates on all things Bitcoin, AI and fintech, subscribe to our New Barbarians Podcast here,

https://www.youtube.com/@TheNewBarbariansPodcast

Keep reading with a 7-day free trial

Subscribe to The Macro Case for Bitcoin to keep reading this post and get 7 days of free access to the full post archives.