U.S. Q1 GDP was Negative, But Will Rebound in Q2?

Investors Shrug Off the Q1 GDP Miss as a One-Time Event

The U.S. is halfway to its second recession since the 2008 Global Financial Crisis. A second consecutive negative GDP print in Q2 would make it official. And while most economists are still betting on a Q2 rebound, we’re not so sure.

If a recession takes hold, it won’t be because of a housing bust or credit collapse. It will be because:

Consumer spending finally aligns with collapsing sentiment.

The growing number of companies pulling 2025 guidance proves prescient, and the feared "air pocket" in demand becomes real.

Before we dive deeper, don’t miss THE LEDGER at the end of our post—our curated feed of signals, players, and tools (like Bitcoin Reserve Monitor and on-chain data from New Hedge) that complement this post and can plug directly into your investment process.

If you would like a free one month trial, please DM me.

Why Q1 GDP Printed Negative

Q1 GDP contracted by -0.3%, marking the first quarterly decline since Q1 2022. The reason? Not falling demand, but front-loaded imports.

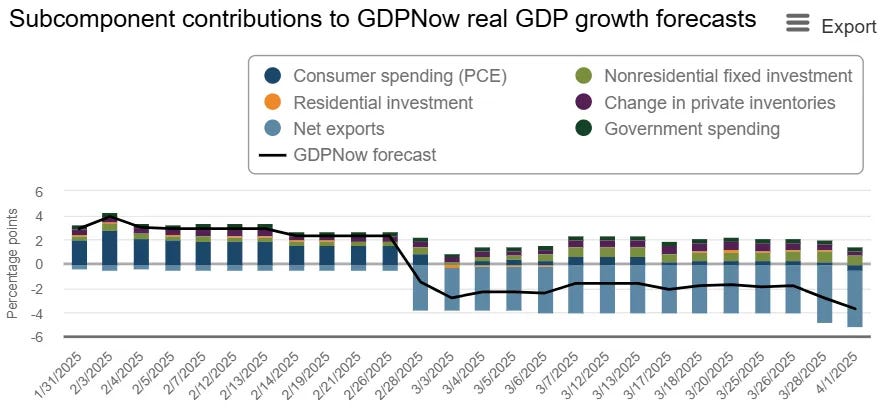

U.S. corporations accelerated purchases to beat the tariffs taking effect post–“Liberation Day.” Exports held steady, but the surge in imports subtracted 4.83 percentage points from GDP—enough to flip the entire quarter negative. That drag won’t repeat, which is why many expect Q2 to rebound. Case in point: the Atlanta Fed’s GDPNow forecast has Q2 tracking at +2.3%, up from the Q1 final of -2.7%.

From our April 2nd post:

“The import surge is distorting GDP prints and confusing forecasters. One day before Liberation Day, net exports had already knocked nearly 5 points off GDPNow.” Graphic above.

Our Three Predictions

1. Bitcoin and Gold continue to outperform.

April set the tone—macro stress, falling growth estimates, and a monetary regime shift drove capital into hard assets. The IMF’s global growth downgrade supports this trend.

2. Wall Street strategists and managers need to retool…its LLMs or bust

This is the second major macro miss of the year (2025 U.S. EPS estimates was the first, as co host Bill Mann noted on our Podcast in January. It appears that model rot and events ‘not in the data’ require a shift in the spirit of adapt or die as passive fees approach zero and alpha remains elusive. More on that in THE LEDGER.

3. Powell’s legacy gets a rewrite.

Despite the fastest rate hikes since Volcker, Powell avoided a second down GDP print—until Trump unleashed Tariffs. During the Fed’s rate hike campaign, they were able to operate under cover of Treasury support via TGA drawdown to mitigate contagion (Aug 2022 Gilt crisis and Mar 2023 Bank Failures). Trump is choosing a different tool to achieve his goals: tariffs with results that are more disruptive, less predictable, and possibly recessionary.

A Coin Toss Recession in a New World Order

We're at a turning point. In the past week alone, both the IMF and Scott Bessent framed what lies ahead as a once-in-a-lifetime shift.

The IMF

From its April 22 report:

“The global economic system under which most countries have operated for the last 80 years is being reset, ushering the world into a new era.”

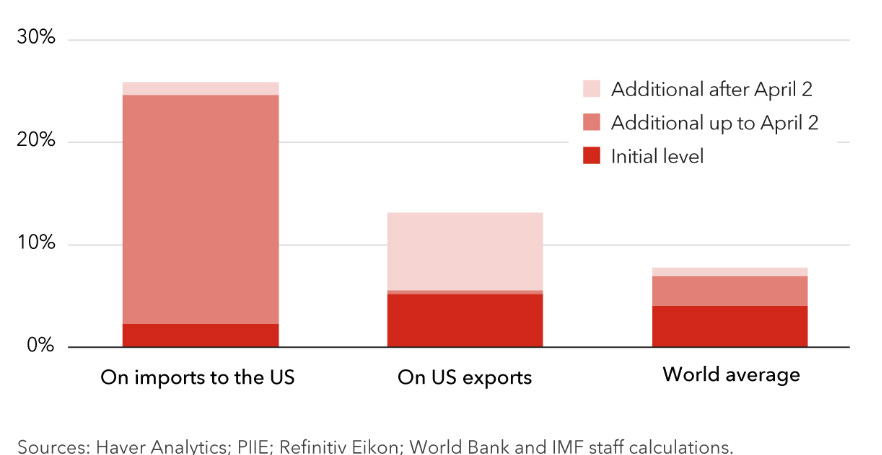

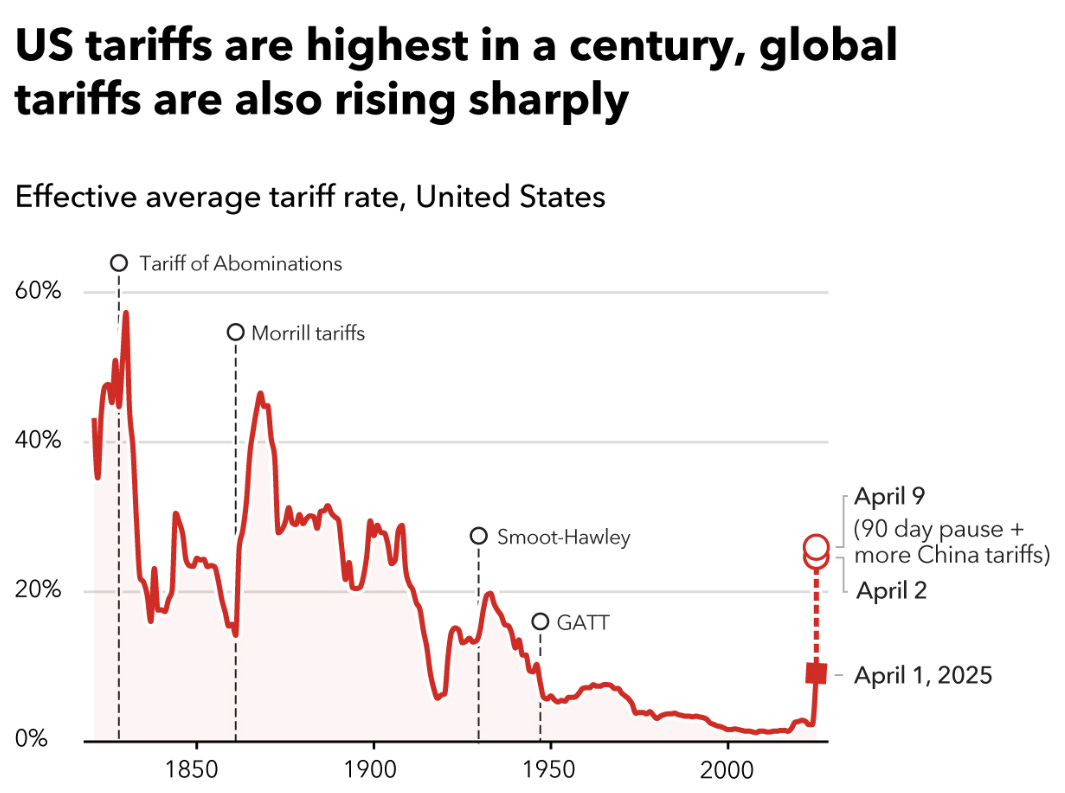

The report noted the still underappreciated impact of tariffs that are still unfolding as shown below.

and drew a historical parallel to Smoot-Hawley, noting the long-term damage tariffs can do to global demand.

Scott Bessent

Bessent’s April 24th speech at the IIF was a call to prepare for structural change with:

A rebuke of the IMF and World Bank’s lost mission since Bretton Woods

A redefinition of “America First” that doesn’t imply isolation

A frank assessment of sovereign debt as a systemic tail risk

A call for a pragmatic—not ideological—energy transition

And a tell: Bessent slipped when he said “stability”, not “sustainability.” in minute 4. The transcript has sustainability, not stability (see LEDGER for links). Bessent fumbled because stability is the real priority—keeping markets functioning amid rising debt, deficits, and fragmentation. Like a fiscal Maslow’s Hierarchy you have to meet basic needs first, before noble efforts can be entertained. Today, that basic need for Bessent is servicing the growing pile of sovereign debt.

In my YouTube short, I break down that moment and its deeper meaning.

Keep reading with a 7-day free trial

Subscribe to The Macro Case for Bitcoin to keep reading this post and get 7 days of free access to the full post archives.